Learn from the Japanese market, the growth of China's prepared dishes

2024-07-27 17:35Japan's prepared dishes originated in the 1950s and industrialized production was earlier than that in China. Due to the similar consumption habits and food culture, the historical environment, development stage and enterprise gene of Japan's prepared dishes industry have reference and learning significance for China.

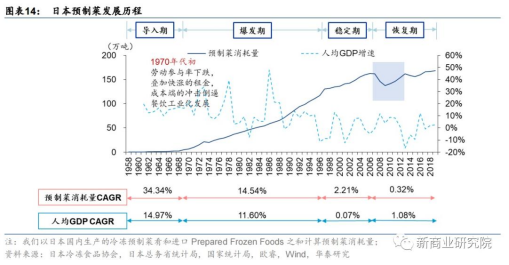

The development of the pre-made vegetable industry in Japan can be divided into four stages:

1) Introduction stage (1958-1967): Japan's frozen food was formed after World War II, driven by the construction of the cold chain, the consumption of pre-made dishes increased from 1,300 tons to 25,400 tons in 1958-1968, of which the 1964 Tokyo Olympics and World Expo purchased a large number of frozen foods, including pre-made dishes, so that the public's awareness was fully improved and people's stereotypes were broken;

2) Outbreak stage (1968-1996): With the rapid development of Japan's economy during this period, the increase in single-person households also increased the overall demand for convenient meals among residents, and the externalization of food and restaurant chains jointly promoted the growth of the industry, and the pre-made dishes ushered in an explosive period in the mid-70s and lasted until the bursting of the real estate bubble in Japan in the 90s;

3) Stabilization phase (1997-2006): Japan's economic bubble and birth rate fell sharply, and the pre-vegetable market grew steadily, but the growth rate slowed down;

4) Recovery stage (2007-present): After the financial crisis, the consumption of pre-made vegetables showed a significant V-shaped recovery, and then remained relatively stable, according to the Japan Frozen Food Association, the market size of Japan's pre-made dishes reached 23.85 billion US dollars (retail caliber) in 2020, of which frozen prepared foods accounted for 85% and clean vegetables accounted for 15%.

It is experiencing a macro and industrial background similar to the outbreak stage in Japan.

In the 70s and 80s, Japan was in the explosive stage of the pre-made vegetable industry, and the demand for B-end and C-end surged, which promoted the rapid development of the frozen food industry, including quick-frozen dishes.

Some of China's current macro indicators are similar to those of Japan in the 70s and 80s, with per capita GDP exceeding $10,000, increasing urbanization rate, and economic development boosting the modernization of society, which is reflected in the smaller family size, but also facing the problems of declining proportion of labor force, rising shop rents, and aging population structure.

Affected by the epidemic in 2020, residents' consumption habits have changed, and the demand for convenient foods such as prefabricated dishes has doubled.

The benchmarking system in Jianzhizhi

Penetration benchmarking: The Japan market is relatively stable, and the penetration rate of pre-made dishes in China lags far behind.

Japan According to the Work Plan of the China Cuisine Association, the penetration rate of Japan prefabricated dishes has reached more than 60% in 2021, while only about 10% in China.

Japan's penetration rate is much higher than that of China for two main reasons:

1) The taste of Japanese food is relatively simple, and the type of diet is relatively fixed, and the prefabricated dishes can meet most of the needs of daily diet;

2) Japan has a small land area and high cold chain logistics coverage, which is easy to form a situation of high concentration.

Category benchmarking: Japan cuisine is relatively simple, but the category mining is more sufficient.

1) Types: Japanese cuisine is divided into Kanto cuisine and Kansai cuisine, both of which are mainly sashimi, sushi, and tempura, but according to the Japan Chinese Food Association, the number of pre-made dishes in Japan has exceeded 3,000; Although there are eight major cuisines in Chinese food, there are less than 1,000 types of pre-made dishes, which is far less than that of Japan, and there is still a lot of room for exploration.

Japan According to the Japan Frozen Food Association, in 2020, the total output value of fried meatballs/fried rice/pork cutlets/hamburgers/udon noodles will be 30.8/23.8/20.0/19.5/1.65 billion yuan (1 yen≈0.05 yuan, the same below);

3) Degree of standardization: The processing of Japanese food is relatively simple, mostly roasted, fried, etc., so the degree of standardization is higher than that of Chinese food; Chinese food has a variety of cooking methods, stir-fried dishes, steamed dishes, stewed dishes, etc., which is more difficult to standardize the research and development of dishes, and it is difficult for pre-made vegetable enterprises to cover multiple cuisines, and the industry penetration rate is not as good as that of Japan.

Pattern benchmarking: The Japan market is relatively mature, and the market concentration is higher than that of China.

According to Zhiyan Consulting, the total market share of CR10 in China's pre-made vegetable industry in 2020 is only 14.23%, while the CR5 market share of Japan's pre-made vegetable industry will reach 64.04%, and the gap between the concentration of China and Japan's industry is obvious.

In fiscal year 2021, the total revenue of Kobe Bussan/Nichirei Food/Ajinomoto / Japan Fisheries Co., Ltd., the representative enterprise of Japan pre-made dishes, is about RMB 322/204/638/39.1 billion yuan, of which the revenue of frozen food is about RMB 183/145/133/12.2 billion yuan, and the Matthew effect is more obvious.

Compared with Japan, China has a larger population size advantage, and Chinese enterprises have broad room for growth.

With a large Chinese population of 1.412 billion in 2020, 11.21 times the total population of Japan, it provides a larger catering and home consumption market, and the ceiling of the prepared vegetable market should be higher, which is expected to give rise to leading enterprises with larger income scales.

The competitive pattern of Japan's pre-made vegetable industry has been determined, and leading enterprises with revenues of more than 20 billion yuan have been born. Referring to Japan's experience, when the industry's high growth dividend gradually fades, enterprises with stronger product power, brand power and supply chain capabilities will settle down in the big waves.

A B-then-C business model

Japan: The pre-made vegetable industry has experienced a development process of B first and then C, and the demand for C end has risen steadily since the 90s.

Review the channel development process of Japan's pre-made dishes, in the mid-70s, the B-end and C-end channel development gradually widened the gap, the B-end channel entered a 20-year rapid volume stage, at the end of the 90s, with the bursting of Japan's economic bubble, residents' willingness to go out to consume declined, the catering industry regressed, and the demand for B-end pre-made dishes declined.

In contrast, C-end demand has maintained a steady growth rate from the 70s to the end of the 90s after the Japan economic crisis through the economic cycle.

After the 90s, the economic development slowed down, the proportion of women working outside the home increased, and the miniaturization of the family, as well as the popularization of household appliances such as microwave ovens/refrigerators, and the gradual rise of C-end consumption.

China: The B-end market started earlier, and the C-end demand still needs to be cultivated.

According to Euromonitor, in 2021, the ratio of pre-made dishes 2B and 2C in the Japan market is 6:4 (sales caliber), and the channel structure is more balanced, and the ratio of pre-made pre-made dishes 2B and 2C in China is about 8:2 (revenue caliber).

China's B-end prefabricated food soil has been relatively mature, chain restaurants, group meals and small and medium-sized restaurants and other penetration has been basically completed, catering enterprises are currently the most important sales channel, C-end demand still needs to continue to cultivate, follow-up or more penetration.

In the past, enterprises that positioned the C-end needed to assume the responsibility of consumer education, and the difficulty of operation was reflected in:

1) On the demand side, C-end consumers have diversified needs and taste preferences are changing with each passing day, so enterprises need to keep up with market trends and maintain a fast update frequency of new products;

2) On the supply side, there may be a series of supply chain problems, such as scattered demand points and high transportation costs, etc., and it is difficult to break through the bottleneck in sales.

During the epidemic, natural consumer education, product innovation and marketing innovation may be the way to break the game.

1) On the demand side, the consumption of home scenes has increased significantly during the epidemic, and fresh e-commerce has flourished in the post-epidemic era, and prefabricated dishes have gradually occupied the minds of consumers.

2) On the supply side, most of the new brands choose to focus on the C-end with a lower threshold, and the prevalence of the Internet has helped diversify the publicity methods, and the marketing methods of enterprises have gradually become more flexible in the near future.

3) On the product side, Zhenwei Xiaomeiyuan has launched special dishes such as sauerkraut fish and Wellington steak, and Xinliang Kee has developed dishes such as spicy crayfish, and creative new products have emerged in an endless stream;

4) On the marketing side, merchants actively embrace community marketing and live broadcast channels, which may further strengthen C-end consumers' awareness of pre-made dishes and become a breakthrough for C-end development.

Common elements of Japanese companies

This section starts with Nichirei Group and Kobe & Co., the leading enterprises of pre-made dishes in Japan, and analyzes how the above enterprises form strong barriers in an all-round way from multiple dimensions, and explores the common factors for pre-made vegetable enterprises to become bigger and stronger:

1) Extensive accumulation of products: Category diversification is an important way to expand the audience, and the importance of product development capabilities is highlighted;

2) Build a high wall of channels: BC should take into account or be a better channel model, and differentiation strategies should be implemented for different channels;

3) Dense supply chain: Improving the supply layout can effectively improve the synergy effect and supply capacity.

Nichirei and Kobe are both the largest pre-made vegetable companies in Japan, achieving revenue of 32.21/20.37 billion yuan in fiscal 2021.

1) Nichirei: Founded in 1942, initially focused on the sale of frozen fish, in the 50s, it began to lay out the prefabricated food business, grasp the opportunity of the outbreak stage of the industry, promote quick-frozen food to the catering end, expand its own popularity, and the company's main business is food processing, logistics, livestock and aquatic products. In FY2021, the company achieved revenue/operating profit of RMB32.21/1.85 billion, -2%/+8% year-on-year.

2) Kobe: Born in Hyogo Prefecture in 1985, it mainly sells frozen food and semi-finished products in the form of business supermarkets, and most of the supermarket chains are operated by franchisees, and the company collects a 1% royalty, and as of May 2021, the company has 927 stores.

In FY2021, the company achieved revenue/net profit of RMB203.7/1.10 billion, +6%/30% year-on-year, with prefabricated food revenue accounting for more than 90%.

According to the company's official website, by the end of 2021, the company has 23 food processing plants in Japan, more than 350 overseas cooperative factories, and a complete system of Chinese production capacity and foreign suppliers.

Product side: Compared with quick-frozen rice noodles and quick-frozen hot pot products, the differentiation of prefabricated dishes is more significant, so the importance of product development capabilities is highlighted.

Nichirei: Outstanding R&D capabilities, star large single products are the core competitiveness.

On the premise of market research and understanding consumer needs, the company has strengthened its own R&D capabilities, and the compound growth rate of R&D expenses in 16-21 years (8.5%) and the R&D expense rate in 2021 (7.3%) are in the forefront of its peers.

In 2021, the company's R&D expenses will reach 143 million yuan, and the technical team will continue to polish new products, and has now launched a variety of foods such as rice, Chinese food, and chicken, mainly deep-processed products such as fried rice and meat patties, and seasoning contributes added value.

The company pays attention to the taste and quality of products, and strives to create a variety of timeless star products, "authentic fried rice" since its launch in 2001 is still constantly improving, with the restoration of the taste of professional chefs, for 20 consecutive years to the top of the sales list of Japan's quick-frozen fried rice category, according to the company's official website, the scale of national fried rice in 2021 is about 600 million yuan.

Kobe: It has a large number of self-operated brand products, and its diversified appearance creates strong product strength.

According to the company's official website, the company provides more than 360 kinds of self-operated brand products, the number of categories is about 5,300, and the number of imported product SKUs is more than 1,400, from 40 countries and regions around the world, with a rich product matrix, and then relies on keen sense of smell and innovation ability to create a product portfolio of Germany sausage, water lamb soup, Tapioka and other products, mainly sold in business supermarkets, refined mining market demand.

On the channel side, both Nichirei Group and Kobe & Co., Ltd. have shifted from focusing on the B-end to the dual-drive of the BC-end, and then through the blessing of related products, they have replicated their dominant position in the B-side.

Nichien: BC two-wheel drive, polishing products to match the needs of segmented channels.

According to the announcement of Nichirei Group, the BC side of the company's revenue in 2021 will account for 55%: 45% respectively. At the beginning of its establishment, the company mainly oriented to school meals, group meals and convenience stores, and matched corresponding products for different channels.

For convenience stores and small B customers, the company mainly promotes chicken products with high cost performance, and for hotel customers, the company's project team can provide customized services and develop medium and high-end products.

With the increasing maturity of the pre-made food industry in Japan, under the influence of the aging population and the miniaturization of families, family demand continues to increase, and Nichirei has also developed more C-end products, such as the company launched a variety of microwave oven cooking products in 1992 to strengthen its dominant position in the family.

Kobe: From the main B-end to BC, the product is cost-effective to build a competitive advantage.

The company sells its goods on a franchise basis and has grown at a rate of about 30-40 new stores per year since the opening of its first operational supermarket in March 2000.

In the early days of its establishment, the business supermarket was mainly for B-end customers such as restaurants and retailers.

According to the company's official website, in order to meet the needs of corporate customers, the business supermarket sells large-scale products to avoid price competition with competing products, because the price is about 20% cheaper than other supermarkets, cost-effective products are also welcomed by C-end consumers, in addition, the business supermarket has created a series of "mother's taste food", positioning housewives, widely favored by the consumer group, and rapidly increasing the number of stores.

On the supply side, prefabricated dishes are quick-frozen subdivisions, which require full cold chain transportation, and enterprises adopt self-built cold chains or outsourcing through third-party enterprises, according to the 2021 China Prefabricated Vegetable Industry Conference, cold chain transportation costs account for 20%-25% of sales.

Nichirei: Upstream fresh food companies provide high-quality and low-cost raw materials, and downstream logistics companies provide efficient global transportation services.

With mature freezing technology and global food procurement network, Nichirei Fresh procures ingredients from more than 30 countries at low prices, providing the company with high-quality and low-cost raw materials, effectively improving food taste and product profit margins.

As of the end of 2021, there are 7 regional cold storage companies and 80 storage-based distribution centers in Japan, with a cold storage capacity of more than 1.5 million tons, ranking first in Japan.

Overseas, Nichirei Logistics started with the acquisition of refrigerated warehouses in the Netherlands and has expanded to Europe and Asia, with a total of 42 bases in 12 countries.

Kobe: The integration of production, supply and marketing, and the self-built cold chain has advantages in distribution routes and delivery timeliness.

According to the company's official website, by the end of 2021, the company had a total of 25 factories in Japan, and most of the products came from its own factories.

The company's layout takes the store as the core, continuously extends to the upstream, and masters the supply of raw materials, product processing and the final sales link, and the integration of production, supply and marketing can provide customers with a diversified product portfolio under the condition of controllable costs.

The cold chain logistics infrastructure has a large investment in the early stage and a long recovery cycle, and can bring cost advantages through scale effect after maturity.

By building an independent cold chain logistics, the company maintains the whole process of low-temperature transportation of raw materials and fresh products, and effectively controls the cost of the supply chain.

Success model: At the valuation level, the PE-TTM of Kobe & Co., Ltd./Nichirei in the rapid growth period is 70-80x/30-35x respectively, and overseas leaders have formed competitive barriers in the three aspects of "product + channel + supply chain", providing reference for the development of Chinese enterprises.

1) On the product side, Nichirei has developed the C-end by enriching the product matrix, helping it become the industry leader, and Kobe's ability to build a large single product to build a corporate moat;

Japan According to Euromonitor, in 2021, the ratio of 2B and 2C of prefabricated dishes in Japan is 6:4 (sales caliber), and both Nichirei Group and Kobe C&o have shifted from focusing on the B-end to taking into account the consumption needs of the B-end and the C-end, and implementing differentiated strategies for different channels;

3) On the supply side, Nichirei actively expands the upstream fresh business, with the downstream logistics layout, Kobe also has a strong upstream and downstream supply chain, Japan has a small land area, leading enterprises in the early stage of development through capital advantages to quickly improve the coverage of cold chain logistics, after the formation of scale advantages, pull up the industry entry threshold.

Referring to the development experience of Japan's leading enterprises, benchmarking overseas and combining with China's actual conditions, there are the following enlightenments:

Japan's pre-made vegetable industry is driven by large single products, Chinese traditional cuisine is huge, cooking technology is complex, taste differences cause the breadth of single products to be mined, the company's product matrix research and development capabilities need to be further improved, improve the taste of dishes, and overcome the problem of "water and soil adaptation" faced in the national expansion.

In addition, the market space of the B-end and the C-end is considerable, and the BC may be a better channel model, and the regional characteristics of China's prefabricated food enterprises are obvious, and the cold chain layout still needs to be improved.